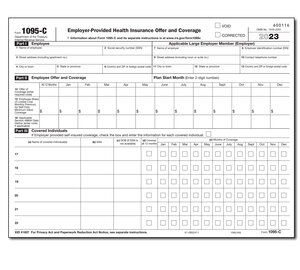

Transmittal Of Employer Provided Health Insurance (3 Pages)

- Priced Per Quantity (Each)

- 25

.3816

- 50

.2676

- 100

.2276

- 200

.2158

- 500

.2156

- Minimum: 25

- Multiples of: 25

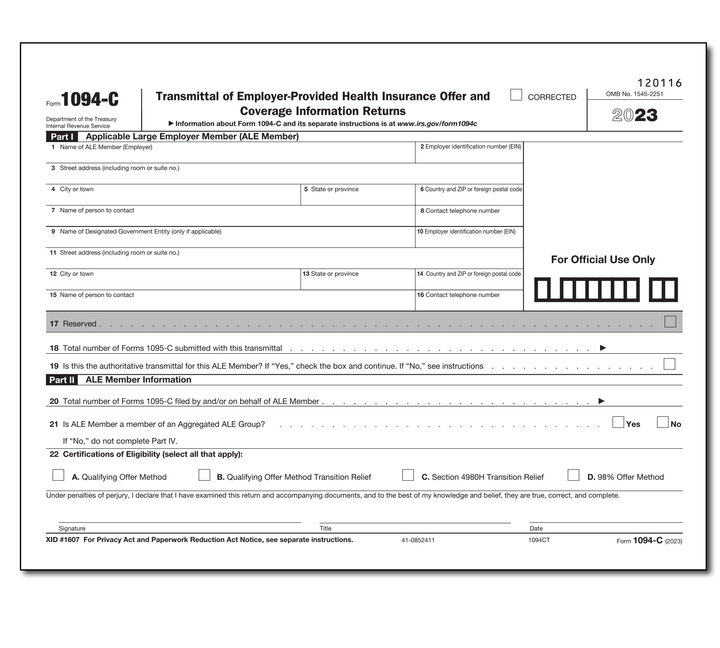

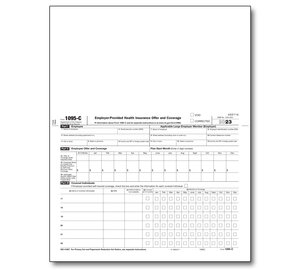

Item: #89-1094c

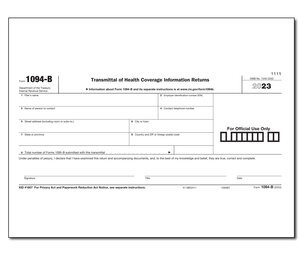

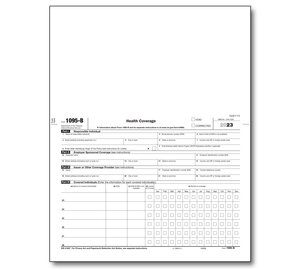

Employers with 50 or more full-time employees (including full-time equivalent employees) in the previous year use Forms1094-C and 1095-C to report the information required under sections 6055 and 6056 about offers of health coverage and enrollment in health coverage for their employees.

Form 1094-C must be used to report to the IRS summary information for each ALE Member (defined below) and to transmit Forms 1095-C to

the IRS.

An ALE Member is, generally, a single person or entity that is an Applicable Large Employer, or if applicable, each person or entity that is a member of an Aggregated ALE Group.

Tax Forms, envelopes and software purchased for the 2024 filing season must be returned by December 31, 2024 to receive a refund.