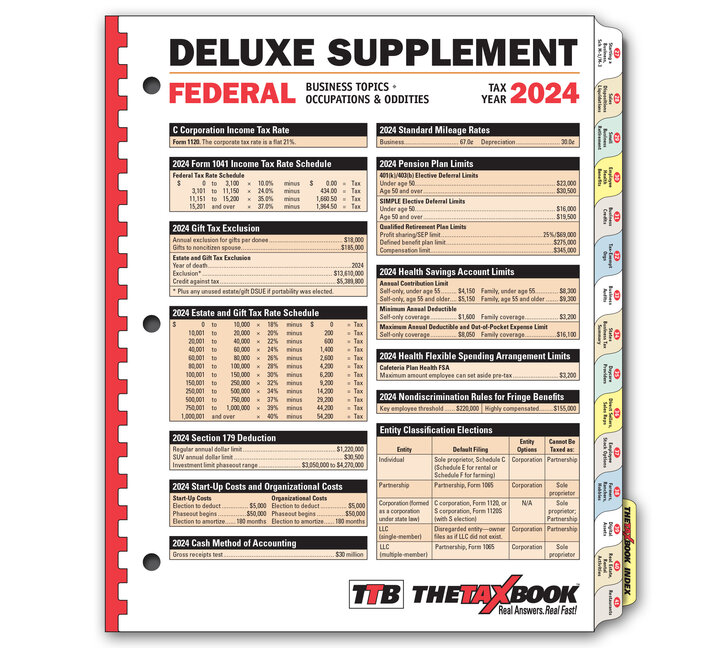

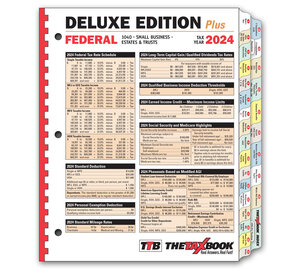

The TaxBook Deluxe Supplement Edition 2024

ONE book for ALL Individual & Business Tax Returns

Authored by the former Authors of Quickfinder Handbooks!

- Priced Per Quantity (Each)

- 1

79.25

- 25

72.20

- 50

69.20

- 100

68.20

- Minimum: 1

- Multiples of: 1

Item: #90-210

Preferred over other Reference Books because: Written by practicing tax preparers, more comprehensive with planning and compliance information, more features than the Quickfinder - faster look up, author commentary, executive summaries, tabbed sections for easy access.

Release Date: mid-December

The Deluxe Edition Includes these tabs:

- 1 - What's New

- 2 - Federal Tax Tables

- 3 - 1040 Line Instructions

- 4 - Itemized Deductions | A

- 5 - Sole Proprietorships; Farmers | C, F, SE

- 6 - Investment Income | B, D, 4797

- 7 - Rental; Passive; At-Risk | E

- 8 - Business Deductions

- 9 - Depreciation | 4562

- 10 - Automobiles; Listed Property

- 11 - Tax Credits

- 12 - Children; College; Family

- 13 - Retirement; Employee Benefits

- 14 - Other 1040 Topics

- 15 - IRS; Penalties; Audits

- 16 - Worksheets; Where to File

- 17 - States

- 18 - C Corporations | 1120

- 19 - S Corporations | 1120S

- 20 - Partnerships; LLCs | 1065

- 21 - Estates, Trusts, Fiduciaries | 1041, 706, 709

- 22 - Financial Planning; Soc. Sec.; Exempt Orgs.

- 23 - Payroll; Labor Laws

- 24 - Business Tools; Worksheets

- 25 - Other Business Topics

- INDEX