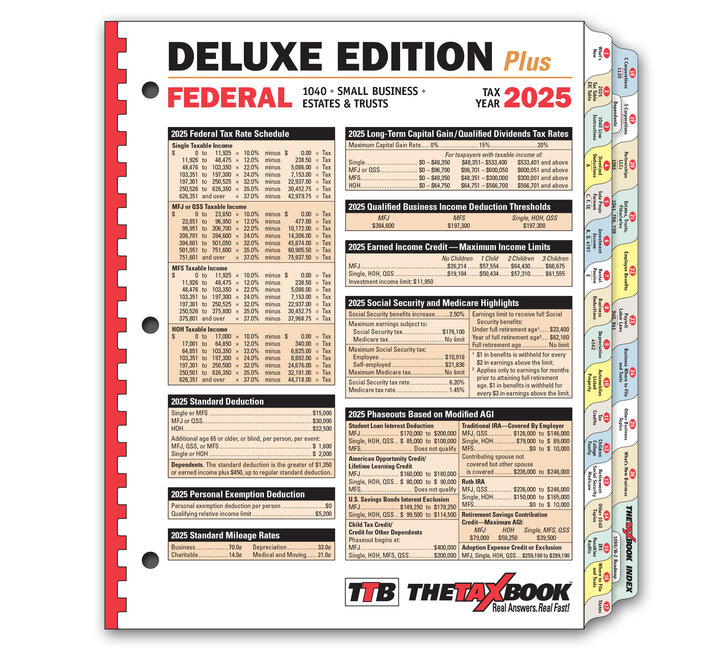

The TaxBook Deluxe Edition 2025

ONE book for ALL Individual & Business Tax Returns

Authored by the former Authors of Quickfinder Handbooks!

- Priced Per Quantity (Each)

- 1

107.35

- Minimum: 1

- Multiples of: 1

Item: #90-211

Newly Updated! Includes updates from recently passed Tax Extenders Legislation. The TaxBook(TM) Deluxe saves you money versus buying two publications!

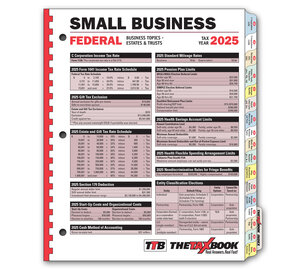

Also file business returns? The TaxBook Deluxe edition includes all the 1040 Edition facts, and adds information on estates, trusts and small business.

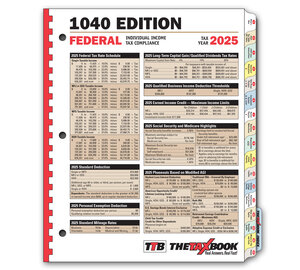

Preferred over other Reference Books because: Written by practicing tax preparers, more comprehensive with planning and compliance information, more features than the Quickfinder - faster look up, author commentary, executive summaries, tabbed sections for easy access, over 300 pages covering every aspect of preparing the 1040 return. Information specific to filing Form 1040.

Release Date: mid-December

The Deluxe Edition Includes these tabs:

- 1 - What's New

- 2 - Federal Tax Tables

- 3 - 1040 Line Instructions

- 4 - Itemized Deductions | A

- 5 - Sole Proprietorships; Farmers | C, F, SE

- 6 - Investment Income | B, D, 4797

- 7 - Rental; Passive; At-Risk | E

- 8 - Business Deductions

- 9 - Depreciation | 4562

- 10 - Automobiles; Listed Property

- 11 - Tax Credits

- 12 - Children; College; Family

- 13 - Retirement; Employee Benefits

- 14 - Other 1040 Topics

- 15 - IRS; Penalties; Audits

- 16 - Worksheets; Where to File

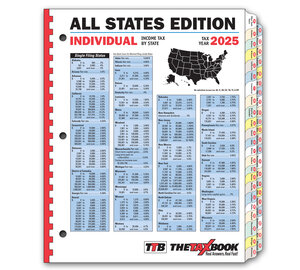

- 17 - States

- 18 - C Corporations | 1120

- 19 - S Corporations | 1120S

- 20 - Partnerships; LLCs | 1065

- 21 - Estates, Trusts, Fiduciaries | 1041, 706, 709

- 22 - Financial Planning; Soc. Sec.; Exempt Orgs.

- 23 - Payroll; Labor Laws

- 24 - Business Tools; Worksheets

- 25 - Other Business Topics

- INDEX

Individual Forms 1040, 2441, 4562, 4684, 4797, 6251, 8283, 8582, 8606, 8829, 8863, 8949 Business Forms 1120, 1120S, 1065, 1041, 706, 709, 941, 940, 990 Schedules 1, 2, 3, A, B, C, D, E, EIC, F, H, S, K-1, M-1, M-2, B-2, PH