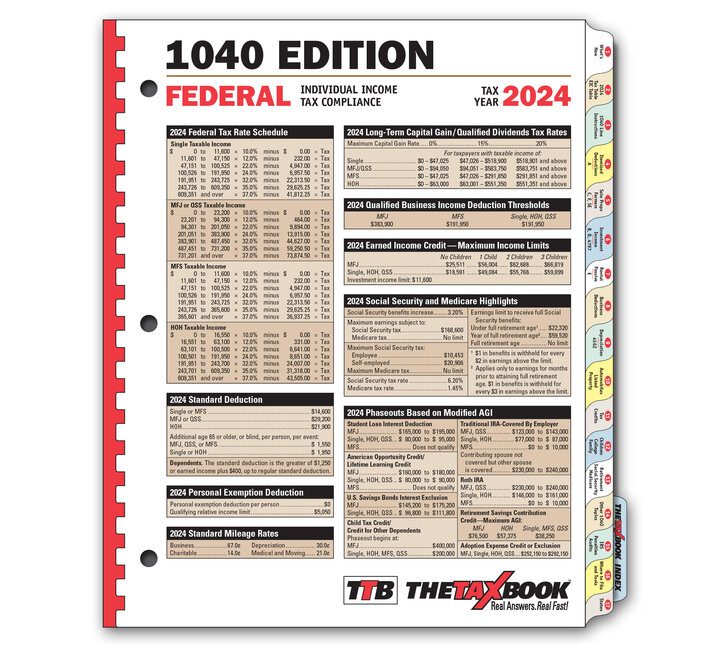

The TaxBook 1040 Edition 2024

Find answers to questions... fast!

Authored by the former Authors of Quickfinder Handbooks!

- Priced Per Quantity (Each)

- 1

79.25

- 25

72.20

- 50

69.20

- 100

68.20

- Minimum: 1

- Multiples of: 1

Item: #90-201

Newly Updated! Includes updates from recently passed Tax Extenders Legislation. The 1040 Edition Includes: Over 300 pages covering every aspect of preparing the 1040 return; Information specific to filing Form 1040.

Preferred over other Reference Books because: Written by practicing tax preparers, more comprehensive with planning and compliance information, more features than the Quickfinder - faster look up, author commentary, executive summaries, tabbed sections for easy access, over 300 pages covering every aspect of preparing the 1040 return. Information specific to filing Form 1040.

Release Date: mid-December

Tabbed sections for easy access including:

- 1 - What's New

- 2 - Federal Tax Tables

- 3 - 1040 Line Instructions

- 4 - Itemized Deductions | A

- 5 - Sole Proprietorships; Farmers | C, F, SE

- 6 - Investment Income | B, D, 4797

- 7 - Rental; Passive; At-Risk | E

- 8 - Business Deductions

- 9 - Depreciation | 4562

- 10 - Automobiles; Listed Property

- 11 - Tax Credits

- 12 - Children; College; Family

- 13 - Retirement; Employee Benefits

- 14 - Other 1040 Topics

- 15 - IRS; Penalties; Audits

- 16 - Worksheets; Where to File

- 17 - States

- INDEX